Please enter your email address and your Map/Lot/Sub numbers. The Map/Lot/Sub numbers are listed on your property tax bill. *NOTE: if a property is in lien status, only the property owner or a person with legal interest is allowed to pay per New Hampshire state law (RSA 80:69).

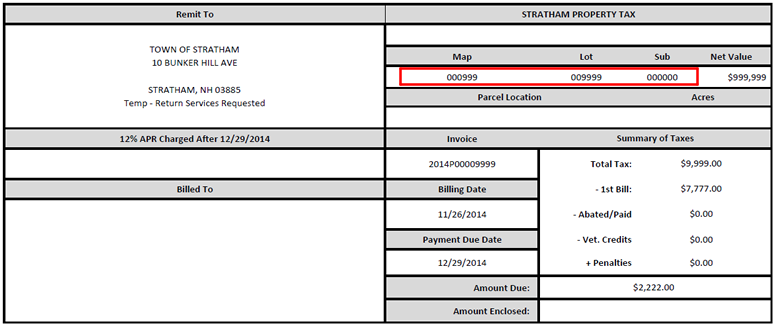

Need help locating it? Sample Invoice